Fishing in Venture

This week, I want to dive into the fascinating world of nuclear fusion, specifically focusing on the recent breakthroughs in Gen4 pebble bed technology. As we strive for sustainable energy solutions, fusion stands out as a potential game-changer. Recent advancements have brought us closer than ever to achieving practical fusion energy, and the implications for both the energy sector and venture capital are profound.

Recent Breakthroughs in Nuclear Fusion

Nuclear fusion, the process of combining atomic nuclei to release energy, has long been pursued for its promise of clean, virtually limitless power. In 2024, researchers achieved sustained fusion reactions with higher efficiency, marking a significant milestone. Key developments include improved magnetic confinement techniques and innovative reactor designs, pushing us closer to viable fusion energy.

Gen4 Pebble Bed Technology

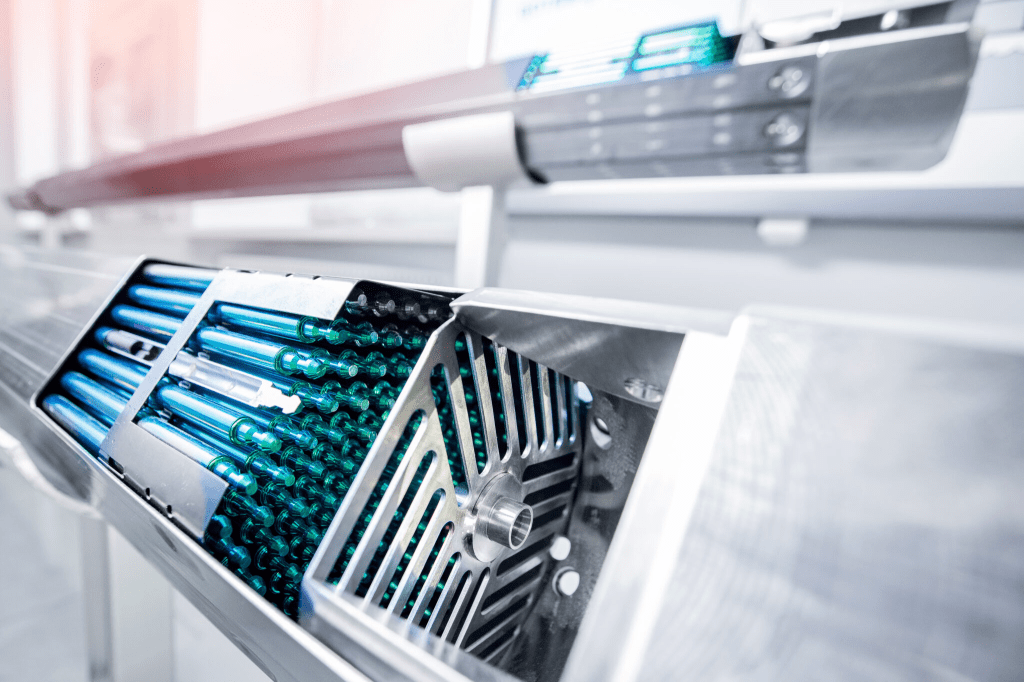

Enter Gen4 pebble bed reactors, a breakthrough in fusion technology. Unlike traditional reactors that use solid fuel rods, pebble bed reactors employ small, spherical fuel elements known as pebbles. These pebbles offer several advantages:

- Enhanced Safety: Their design inherently prevents overheating, reducing the risk of meltdowns.

- Higher Efficiency: The modular nature allows for better heat management and energy conversion.

- Scalability: Smaller, more manageable units enable easier deployment and maintenance.

This technology not only enhances the feasibility of fusion reactors but also promises a more adaptable and safer energy source.

Fish of the Week

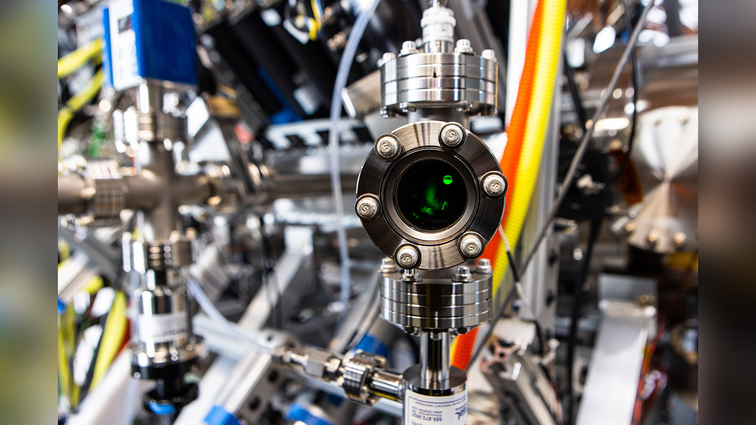

This week, let’s spotlight Zap Energy, a groundbreaking startup in the fusion energy sector. Zap Energy is pioneering a compact, scalable fusion reactor that doesn’t rely on magnetic confinement. Instead, they use a sheared flow stabilized Z-pinch device, which simplifies the reactor design and reduces costs.

The Storyline: Founded in 2017 by physicists from the University of Washington, Zap Energy emerged from a shared vision to make nuclear fusion a practical energy source. The founding team, including Dr. Uri Shumlak, Dr. Brian Nelson, and Dr. Ben Nelson, had extensive backgrounds in plasma physics and fusion research. They believed that the traditional approaches to nuclear fusion were too complex and costly.

Their breakthrough came with the Z-pinch concept, which had been considered theoretically promising but had never been practically achieved due to stability issues. The team’s innovative solution to these problems paved the way for the development of a working prototype. Early funding came from grants and seed investments, allowing them to set up initial experiments and validate their theories.

Key Highlights from Crunchbase:

- Funding and Growth: Zap Energy has raised over $160 million across multiple funding rounds. Their latest Series C round, led by Lowercarbon Capital, brought in $160 million, showcasing strong investor confidence.

- Innovative Technology: The Z-pinch device promises a more straightforward and less expensive path to fusion energy, potentially accelerating the commercialization timeline.

- Strategic Partnerships: Zap Energy has formed key partnerships with national laboratories and private research institutions, enhancing their research and development capabilities.

- Future Prospects: With ongoing advancements, Zap Energy aims to develop commercial-scale fusion reactors within the next decade. Their mission is to provide a clean and virtually limitless energy source to meet global demands.

Traction and Achievements:

- Prototypes and Testing: Zap Energy has successfully tested their prototype reactors, achieving promising results that demonstrate the viability of their technology.

- Market Potential: The global push for clean energy solutions positions Zap Energy at the forefront of the next energy revolution, with significant market potential in reducing carbon emissions and providing sustainable energy.

For more detailed information, visit their Crunchbase profile.

Ebbs & Flows

How to analyze a pitch with an investor lens

Evaluating a founder’s pitch is a critical skill for any investor and honestly, it takes time and reps. So, here are a few things that I’ve learned specifically in my limited time in VC.

- Vision:

- Key Questions: Does the founder clearly articulate the problem and their solution? Is the vision compelling and easy to understand?

- What to Look For: Clear, concise explanations and a compelling vision that resonates with you/your thesis.

- Market:

- Key Questions: How well does the founder know their market? Do they have insights into market size, customer needs, and competitive landscape? I love to ask the question – “Would someone pay for this?”

- What to Look For: Detailed knowledge of the market, realistic assessment of competition, and an understanding of customer pain points.

- Business Model:

- Key Questions: Is the business model viable and scalable? Are the revenue streams and cost structure sound?

- What to Look For: Clear revenue generation strategies, scalability potential, and a well-thought-out cost structure. With any startup that touches data I love to ask how they plan to monetize their data and or drive insights.

- Traction and Metrics:

- Key Questions: What traction has the startup achieved so far? Are there key metrics like user growth, revenue, or customer feedback?

- What to Look For: Demonstrable traction, positive customer feedback, and robust growth metrics. This will vary depending on the industry. Traction has been a huge buzz word in the VC rhetoric recently. Traction can relate to funding, revenue, free users, data validation, or anything that points to growth.

- Team:

- Key Questions: Does the team have the necessary skills and experience to execute their vision?

- What to Look For: A strong, diverse team with relevant expertise and a track record of execution. This isn’t the end all be all but you need to find a team that surrounds themselves with smarter people and people who can drive growth.

- Financials:

- Key Questions: Are the financial projections realistic? What assumptions underlie these projections?

- What to Look For: Realistic financial projections, a clear understanding of key financial drivers, and a sensible burn rate. What is realistic though? You could glean this information from similar public companies and or just a sanity check. Will they even have the resources to onboard X amount of clients to support their revenue growth claim?

- Design: (I just learned this from Jason Calacanis!)

- Key Questions: How does the design of the product or service stand out? Is it user-friendly and appealing? How does it look compared to competitors?

- What to Look For: Intuitive, user-centric design that enhances the user experience and sets the product apart from competitors. This could be very subjective and usually doesn’t apply to life sciences or biotech. But, it’s important.

Practical Tips for Investors:

- Engage with Prototypes: If possible, interact with a prototype or demo to understand the user experience and design. If I’m interested in investing in a startup, I always get a product demo. It’s crucial and honestly usually tells a better story than the founder.

- Request Detailed Metrics: Ask for specific metrics and case studies to validate traction and market understanding. I always ask for cohort analysis and what they learned from their first customers. Another question I ask consistently is how are customers expanding within the product. Are they using it more? Are they buying more of it?

- Evaluate Team Dynamics: Spend time with the team to gauge their dynamics and passion. Quick note on passion – usually companies are successful when the founder is obsessed with the problem more so than the solution itself. It’s easy to weed out founders who just found a problem they don’t really care about and just make some sub-par solution. The founders who have a burning passion to succeed are the ones that know the problem and hold conviction to it.

- Review Financials Thoroughly: Ensure that financial projections are backed by sound assumptions and a realistic understanding of the market. Usually I would do a lot of this during due diligence but it’s helpful to rate a company on the velocity that they’re achieving. Specifically with finances. Currently, the VC space values capital efficiency

If you’re interested in learning more about analyzing pitches or need help evaluating a specific opportunity, feel free to reach out. The only way to get better is to get reps. I don’t have a ton of reps but everyone you take is a learning opportunity.

Thank you for your support!

Dawson J. Racek