Fishing in Venture

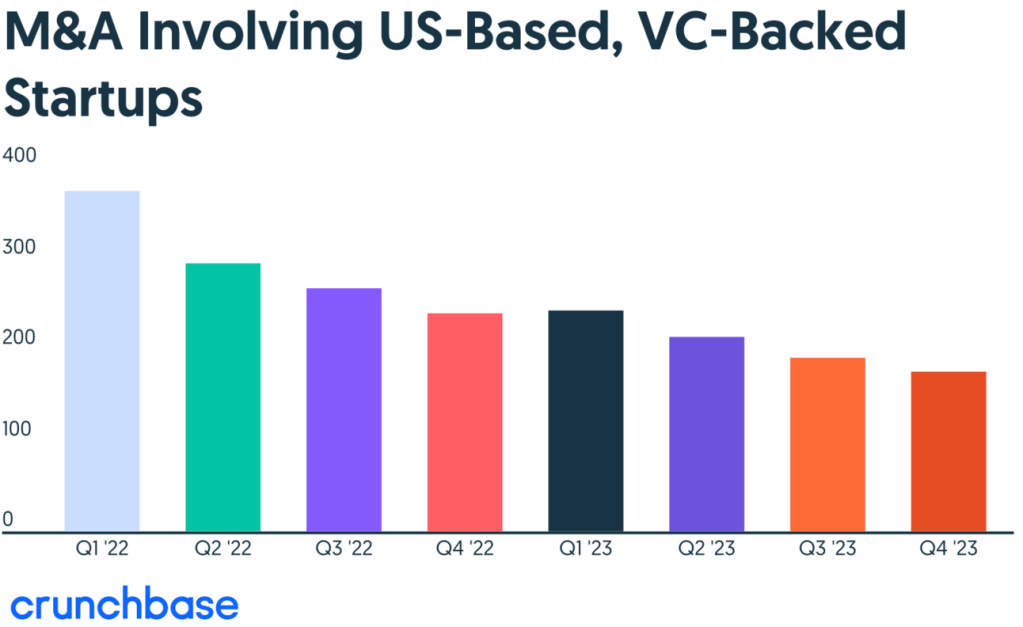

This week I read an article by Crunchbase about the overview of 2023’s rough M&A (mergers and acquisitions) market for startups – marking a significant downturn. The decline in M&A, hitting an eight-year low (down 31% YoY), serves as a stark reminder of the cautious approach adopted by many in the face of uncertain valuations and a stalled IPO market. The year 2023 was belabored with the words “economic downturn” but what does that actually mean?

Most of us felt the impact through higher gas, grocery, and electric bills. When the Fed raises interest rates, it generally aims to cool down inflation by making borrowing more expensive. This move can have a broad impact across the economy, trickling down to affect both individuals and businesses. For startups and venture capital, higher interest rates can lead to tightened spending and a drop in investment dollars as the cost of borrowing increases. This slows down venture investments and startup growth, as both investors and companies become more cautious with their finances, prioritizing stability and cash flow management in a higher-cost capital environment. This creates a perfect storm as companies slow down spending and investors hold onto their cash the economy starts to slow down therefore driving up prices for products and services. Corporations are less likely to acquire startups because of their restricted spending measures. In turn, early-stage funds aren’t realizing the returns.

The coming year, 2024, looms with its own set of challenges and uncertainties. With the Federal Reserve holding rates steady, consumers aren’t fully able to spend and invest at a growing rate. We also are at the start of an impending election which historically adds to economic unpredictability. Consumer spending has been trending up the past few months so I believe 2024 will be brighter than 2023. But – I’m an optimist. Sectors like artificial intelligence, however, have proven to not only be resilient but to thrive, capitalizing on the accelerated digital transformation across all industries.

As we float deeper into 2024 (how are we already in February?), it’s crucial to write our own stories. Times like these are where people reinvent themselves and change culture. My pastor this week actually put it really nicely “Find friends to go change the world together”(Source). The journey that we are on is never without its storms, but I believe that the storms and failure are catalysts for success if we make them.

Fish of the Week

So, I may be a little biased on this week’s “Fish of the Week”. I was lucky enough to catch up with Lavell, the founder of Brag House. Before I get into the segment, I want to recognize all Lavell has done for me. Lavell was the first person to make the first bet on me. Hiring me as a freshman in college to help lead his expansion into the ACC market. Our personalities, goals, and dreams instantly matched when we met. He opened up his startup to me like it was a sandbox to play in. Letting me get my hands on anything I could find. I learned a ton thanks to the Brag House. I met some amazing people, learned how to keep a startup afloat, keep it growing, and keep it dreaming. My 2 year stint with them catapulted me into who and where I am today. I am passionate about founders who are gritty like Lavell and dream big. So, Lavell, I cannot thank you enough for the impact you have had on my life.

From Dorm Room Dream to Gen Z Powerhouse:

Brag House, a startup that’s revolutionizing the way college gaming communities engage and compete. Lavell, a former college athlete turned corporate lawyer and serial entrepreneur, along with his co-founder, spotted a gap in the gaming landscape. Brag House wanted to create a community where casual gamers, united by their love for gaming and their alma mater, come together to compete, trash talk (lovingly, of course), and celebrate their shared passion. They saw that while professional gaming was booming, casual college gamers were looking for a community. Enter Brag House, a concept that turns college rivalries into epic esports tournaments.

Brag House isn’t just another gaming platform; it’s a tidal wave in the esports world. While the industry boomed, with billions pouring in and Gen Z emerging as a powerful spending force, the vast majority of gamers – the casual, fun-loving folks who weren’t chasing pro dreams – were left out. They craved community, competition, and a space to connect with their peers over their shared passion. And where better to find that than in the vibrant, spirited world of college campuses? They tapped into the existing fabric of college rivalries, transforming school spirit into exhilarating esports tournaments. It’s like the March Madness of gaming – complete with live streams, commentary, and the ultimate bragging rights. But what makes Brag House unique is its community-first approach. Their “Collegiate Leads Program” empowers students to be ambassadors, creating an authentic, grassroots wave of enthusiasm.

More Than Just Games – Building the Future:

The success of Brag House has been nothing short of spectacular. They’ve become a prime marketing channel for major brands like Coca-Cola and McDonald’s, offering unparalleled engagement with Gen Z. Their tournaments aren’t just a display of gaming prowess; they’re a gateway for brands to connect authentically with a new generation. And the numbers speak for themselves – with cost per click and impressions rates far outperforming industry averages, Brag House is reeling in success. At the Brag House, they want to shape the future of community engagement and brand interaction. They’re poised to become a data analytics powerhouse, understanding Gen Z’s behaviors and preferences like no other. As Brag House continues to write its story, they’re not just creating a platform for gamers; they’re building a bridge between college spirit, gaming passion, and the future of consumer engagement.

So here’s to Brag House – where I first fell in love with startups & storytellers. Thank you again Lavell!

If you want to learn more about the Brag House or find out how to help – reply to this email and I will connect you with the Brag House team!

Ebbs & Flows

A big part of why I wanted to break into VC was because of the active board positions that VC’s serve on. I saw many principals and managing directors on multiple boards of their investments with the goal to strategically grow the startup towards an exit. So, this week we’re diving into the pivotal world of Boards of Directors and their instrumental role in steering startups towards success. While the concept of a board might evoke images of formal meetings and corporate governance, their impact on startups is both profound and multifaceted.

The Role of Boards in Startups

At its core, a Board of Directors serves as the governing body for a company, providing oversight, strategic guidance, and support to the management team. In the startup ecosystem, where the waters are often uncharted and the tides unpredictable, a well-constituted board can be the compass that guides a venture to safe harbor.

Boards are particularly valuable for startups in several key areas:

1. Strategic Direction: The board helps in setting the company’s strategic direction, ensuring that the startup remains aligned with its long-term goals while navigating short-term challenges. A startup has to stay focused and keep in line with the core business focus so they don’t lose focus and get off track with where they have succeeded.

2. Networking and Partnerships: Board members often bring extensive networks of industry contacts, management hires, potential partners/acquirers, and customers, which can be invaluable for a growing startup.

3. Credibility and Trust: Having established industry leaders on the board lends credibility to the startup, making it more attractive to investors, acquirers, customers, and potential employees.

4. Financial Oversight: Boards play a critical role in financial oversight, from fundraising strategies to budget management, helping startups maintain financial health and accountability. A startup’s main goal should be to create an exit (return on investment) for its investors. If you don’t want to exit, then don’t raise VC dollars!

Constructing a High-Impact Board

Building a board that adds value requires careful consideration. Diversity in expertise, industry experience, and networks can enrich a board’s effectiveness. It’s also vital to ensure alignment on the vision for the company, clear expectations around roles, and a culture of open, constructive dialogue.

Challenges and Considerations

While the benefits are clear, managing a board comes with its challenges. Balancing the input and expectations of board members with the founders’ vision requires gritty and transparent leadership. Additionally, as startups evolve, the composition of the board may need to adapt to reflect the company’s changing needs and strategic focus. Boards of Directors are not just a corporate formality; they are a critical asset for startups, offering strategic guidance, industry insight, and operational oversight. Assembling and effectively engaging with a board can significantly enhance a startup’s trajectory, helping it navigate the ebbs and flows of the business world.

Thank you for your support!

Dawson J. Racek